Introducing Cross Yield: High-Powered Multi-Chain Yield Optimization on Binance Smart Chain, Avalanche, and Polygon

Launching in October 2021. Audits are underway. The release date is imminent.

🔗 Quick Links: BSC Deposit or Zap | Avalanche Deposit or Zap | Bounty | Audits

🧑🏽🌾 Summary:

We’re launching a multi-chain yield aggregator called Cross Yield with insanely optimized strategies on Binance Smart Chain, Avalanche, and soon after Polygon;

It has passed audits and we are waiting on a few more to come back before officially launching;

The name for the yield IOU tokens will be HotYield because it’s hot;

These tokens may sometimes also be used on Cross Pool to get an additional yield on top of yield—DeFi composability at its finest;

The launch date for this product is a few weeks from now pending final signoff;

HOTCROSS & HOTVIP stakers will benefit from this. More on that soon;

🚨 Absolutely do not attempt to interact with mainnet smart contracts randomly or you may get rekt without question. Slow and steady we go; the launch is imminent.

The Rundown

The last few weeks at Cross Pool have been quieter than usual (it’s still going super-well; you should be participating in platform opportunities).

There’s been a reason for that, not least of which is the launch and audit process of four new products in our stack: Cross Send, IHO’s, Launchpads, and HOTVIP. This also includes being chosen as a BSC MVBIII monthly star, which we deeply appreciate (📺 watch it again).

⭐️ We’re now proud to share the latest product which has been running under a controlled testing environment on mainnet for weeks and is in the process of undergoing several security audits from the top names in the industry including Beosin, SlowMist, Omniscia, CertiK, and others. (If you’re a security professional and wish to work with us, 📧 get in touch!)

🔥 Cross Yield: Multi-Chain (Hot)Yield

We’ve spent so much time during the last half-year observing the behavior of stakers and participants in the Hot Cross Protocol, Cross Pool, Cross Mint, Cross Send, and the other products that we develop.

One thing is clear: people do care about yield however there must be a healthy push and pull between a platform and its community. For the sake of simplicity, we’ll call them users.

In short, users and a platform must exist in harmony with both giving to the other or a project may die out easily or simply slowly drift away under the weight of unsustainability.

Those pools and farms you see? Well, that yield has to come from somewhere and it’s usual team subsidized in one way or another. That is not sustainable into eternity.

This is something that we’re attempting to solve by both offering Cross Pool but also leveraging the thousands of yield opportunities on Binance Smart Chain, Avalanche, Polygon, and others through AMM farms like PCS, ApeSwap, Trader Joe, Pangolin, QuickSwap, DYFN, and also Cross Pools themselves.

This helps HOTCROSS LPs, HOTCROSS stakers, and soon HOTVIP stakers in that it will be possible to get more sustainable yield through our suite of products but not in a way that is destructive to the platform.

We are tool builders, not a farming buffet, so instead of promising ridiculously high yield on the base asset of our protocol—HOTCROSS—we’d rather leverage yield across the entire multi-chain ecosystem along with dashes of HOTCROSS incentives to keep everyone happy at the same time.

Remember, when you take, you must give. Otherwise, it is not possible to continue on a balanced path. We wish to be around for many years and adding a yield optimizer into our tool suite makes that so much more possible now.

And yes, when this launches, expect there to be an incentivized program for people who enter Cross Yield and take their receipt tokens over to Cross Pool.

🚨 Do not attempt to interact with these mainnet smart contracts unless you wish to get rekt. They are undergoing audits by 5 companies and will not be the final iteration that we deploy out upon launch.

🧪 What is a Yield Optimizer?

This will be short and sweet. It works like this for the Cross Yield end user:

Deposit or Zap (!) into the optimizer (e.g. CAKE or HOTCROSS-BUSD LP ApeSwap)

Receive back an IOU (e.g. HotYieldCAKE or HotYieldHOTCROSS-BUSD)

You hold that and let the yield optimizer compound yield for you.

Or, if we have a Cross Pool open for staking HotYieldCAKE or HotYieldHOTCROSS-BUSD (by example) you could put that into Cross Pool and make additional yield on top of what you’re already making.

Magic!

Example: Deposit on Binance Smart Chain Using $BANANA

🍌 You put in BANANA, you receive HotYieldBANANA, and you get optimized APY due to the strong yield strategies that we develop. Yield strategists are also welcomed to participate and receive part of the yield emitted through Cross Yield.

Example: Zap Deposit on Binance Smart Chain Using $BNB/WBNB to stake HOTCROSS-BNB PCS LP’s for CAKE

You zap in BNB, you receive HotYieldHOTCROSS-BNB, and you get optimized APY due to the strong yield strategies that we develop. Community yield strategists are also welcomed to participate and receive part of the yield emitted.

Examples on Avalanche. The Same Principles Apply.

The following are examples of using a normal deposit of an LP and a Zap in. The purpose of Zaps is so that you don’t have to have an LP to easily enter into Cross Yield. You Zap in and you’re done.

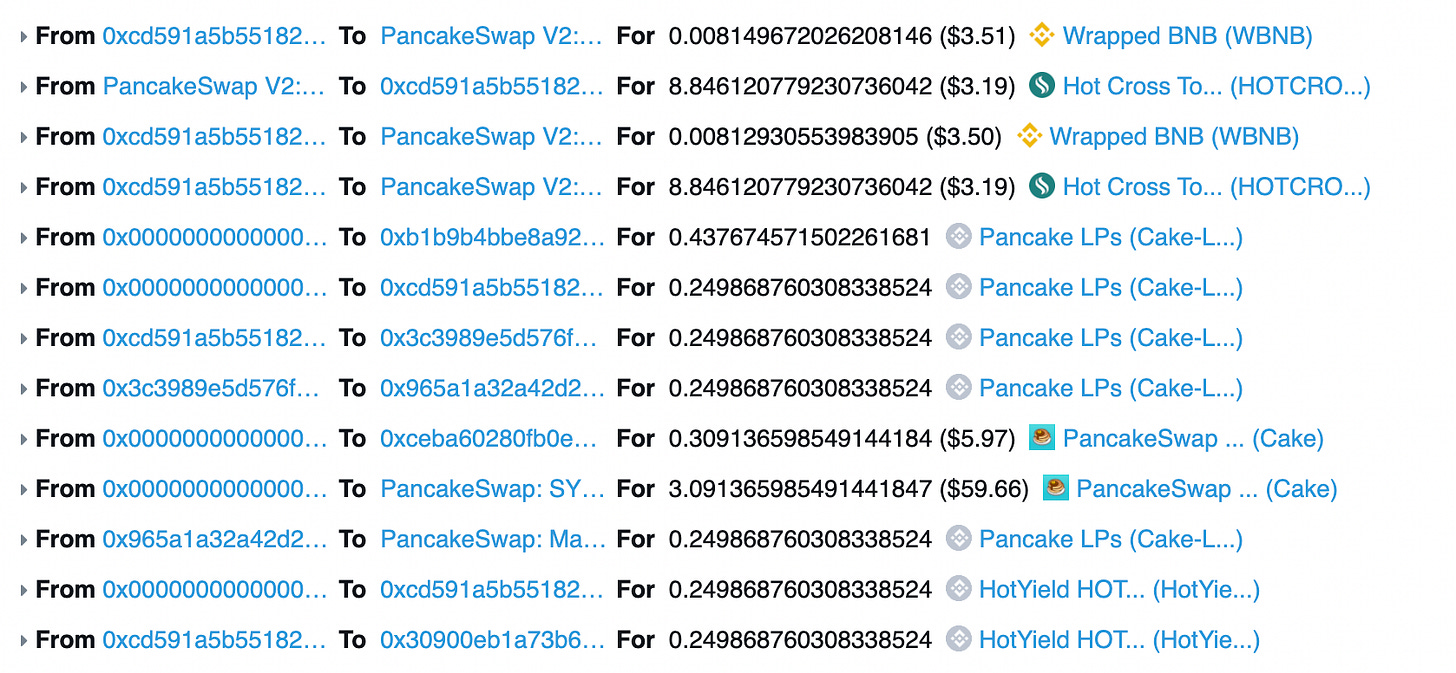

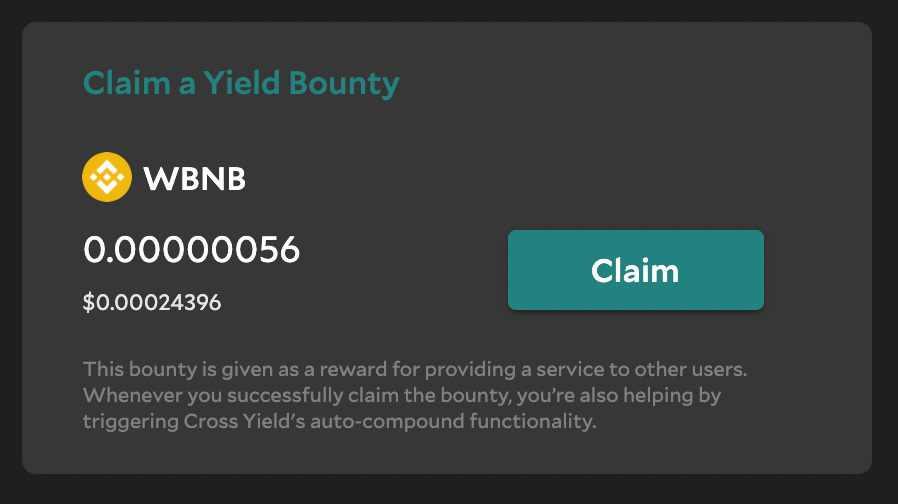

🏹 Finally, the Claim a Yield Bounty.

Those who help to compound the Cross Yield vaults will receive a Bounty that accumulates until someone claims it. This incentivizes action when a vault is asking to be compounded. The bounty is essentially a reward for providing a service to others.

Wrapping it Up

TLDR is that we’re launching a multi-chain yield optimizer that has already passed two audits and is undergoing three more. We’ll launch on BSC and Avalanche first, then Polygon very soon after. We’re insanely excited about how this will help others gain better compounded yield on their AMM farm LP’s but also how it will come into play when we stack Cross Pool on top of it with Sizzle Pools.

ETA to launch is the end of month. The audits are done, we’re simply testing and testing and testing as we always do with products pre-launch. It’s been thrilling to test this on mainnet and having it go mostly smoothly. Exciting times ahead for the Hot Cross product suite!

🤝 Interested in participating in a Cross Pool, Hot Cross IHO, or launching out your idea on any ETH and EVM Network we support? Get in touch. We’re waiting to hear from you.

Ongoing Work at Hot Cross

🔺 Hot Cross and $HOTCROSS Have Officially Arrived on Avalanche. Multi-Chain Bridge Live.

Hot Cross Enlists Wintermute as Its Official Market Maker and Liquidity Manager

Introducing Initial Hot Cross Offerings (IHOs), $HOTVIP, and Multi-Chain Launchpads by Hot Cross

Introducing Cross Send: A Multi-Chain ETH and EVM Network Token Sender

Ongoing feedback loop for the products we’re building, including the minter

📣 Tell a friend about @hotcrosscom, @hotcross, @hotcrossann. It would really mean the world to us. We have been building since last year, but we work like it's still the beginning. Bookmark Linktree and subscribe to our updates for more.

About Hot Cross

Hot Cross is an extensive multi-chain and cross-chain tool suite that enables blockchain teams and their communities to thrive. At its core, Hot Cross aims to be the best toolbox for ETH and EVM networks. Their development philosophy is agile, and they are a cohort of builders who aggressively seek out opportunities to meet the demands of the now for both B2B and B2C. The core thesis that Hot Cross presents is that users and teams will migrate in part to new networks that feel familiar when presented with good tooling and freedom. Hot Cross is a company and an ecosystem in and of itself, and our goals are towards allowing communities to flourish using our technologies, whether or not they know we are the ones building them.

Website | GitHub | Twitter | Telegram | Chat | Reddit | Instagram | Facebook